Money in orbit

The monetary universe we'll be exploring in the next few months

When asked to describe money, we often lapse into vagueness. We might, for example, give a rough account of the ‘functions’ that money apparently has (an approach typical to economics textbooks), whilst alluding to it having, or being, ‘value’.

In regards to the latter, economists make all manner of wishy-washy statements like ‘money is store of value’, or ‘money represents value’ or ‘money is value’. Linguistically, this should strike us as weird, because imagine we said something like ‘a box stores cereal, represents cereal, as is cereal’. In the case of a cereal box, we’d immediately know it couldn’t be all of those, but when it comes to money we seem prepared to accept these broad and imprecise statements.

Many of our societal systems are large, complex and hard to see, but that doesn’t mean they don’t have a definite structure. Our waste disposal systems, for example, can be mapped out spacially, with particular companies that pick up refuse and take it to particular depots. Similarly, our monetary system has a literal structure that is engineered and upheld by particular institutions. It’s not magical, or held up by belief, and neither is it some kind of smoke-and-mirrors fraud. It’s concrete and technical but lies largely out of sight.

This leaves us susceptible to statements like ‘money is value’, which is largely empty, inaccurate, and - worst of all - operates as a euphemistic distraction to avoid talking about what the monetary system actually is.

So what is it then?

We’ll have to nuance this out over time, but - in short - the monetary system is a system of economic access tokens, issued by powerful actors, which are activated within legal systems (which are underpinned by political power). More specifically, it is a composite system of…

Level 1 state IOUs issued by central banks and treasuries, some recorded in digital form in datacentres, and some issued in physical form

Level 2 digital IOUs issued by banks, recorded in datacentres

Level 3 digital IOUs issued by ‘plug-in’ institutions (e.g. Paypal), recorded in datacentres

… which are issued into (and can be pulled out of) a vast interdependent web of strangers - including you and me - to whom they serve as network access tokens which can be used to mobilise labour, and which - when entrenched - are held in place by powerful network effects that supercede any individual person’s opinion on money.

The multi-tiered system is operationalised through specific infrastructure in specific places. For example, this un-marked fortified gate in Scotland…

… leads into this compound…

… which is one of the Royal Bank of Scotland’s datacentres. RBS is one of the ‘Big 5’ mega-banks in the UK, and is joined by others like Barclays, which has its datacentres in places like Gloucester. Here to be precise.

These are the types of datacentres that banks use to keep account of the digital money they’ve issued, which in the UK makes up over 90% of the money supply.

Revisiting the ‘hovering banks’ image

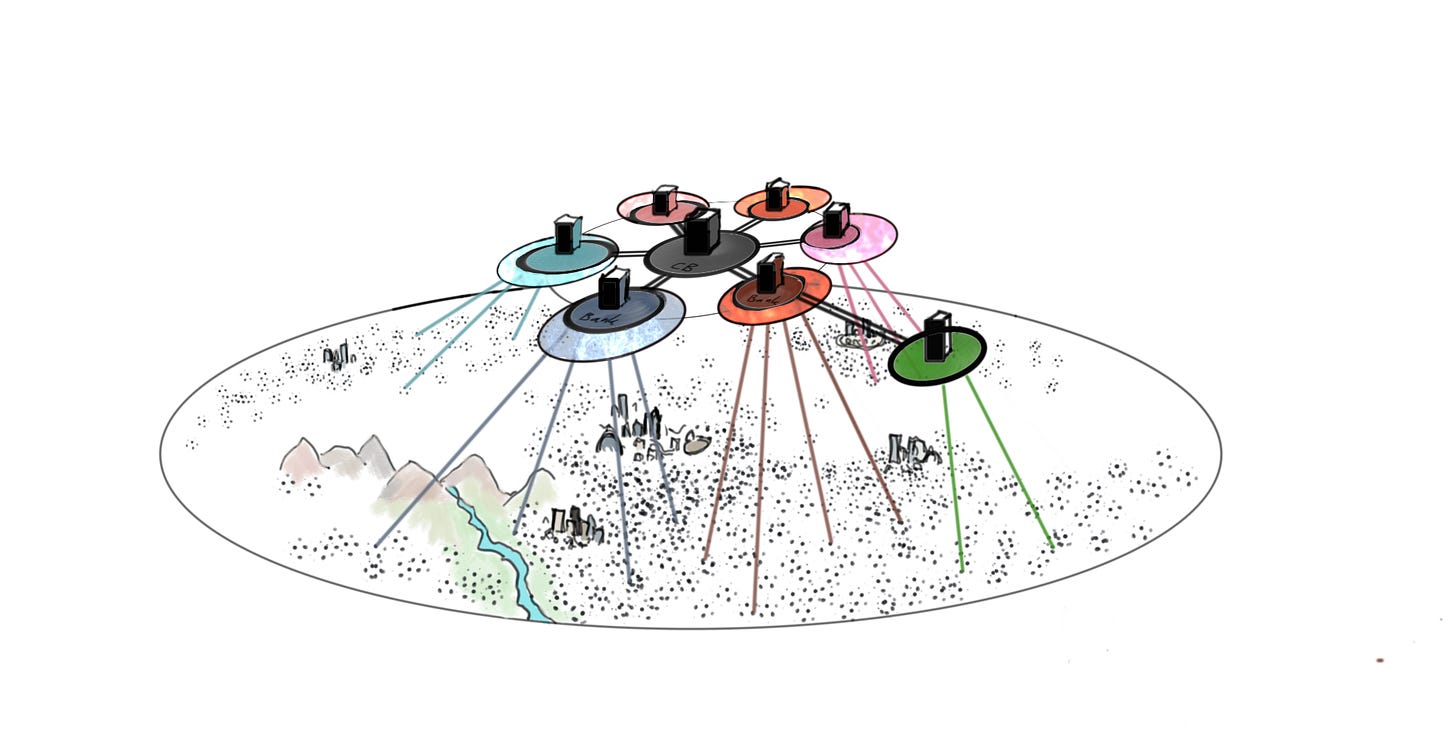

In a previous newsletter (‘Money is complex but looks simple’), I introduced the ‘hovering banks’ image, which is an approach I’m experimenting with as one way to visualize this monetary system.

Basically I take bank datacentres - like the ones pictured above - and draw them as rectangular boxes. I then ‘hoist’ them into the sky and show them hovering above society (with landscapes, cities, people and businesses down below).

Us ordinary mortals on the ground can get addresses in those datacentres (what we commonly call ‘accounts’), which is where banks record their promises to us. We can make requests to have those edited by sending messages through phones and computers, or by walking into branches, all of which act as ground-level transmission posts to communicate with the bank). In the image I represent these connections between us and the banks as spokes.

Now, the banking system obviously does not hover in the sky, and - as we can see in the earlier images - their datacentres are on the ground (or even under the ground), but the visual elevation is conceptually useful, both for showing how the structure works, but also for conveying its power and increasing tendency to loom over us, watch us, and steer our behaviour.

In the coming months, I’ll be delving deeper into specific sections of this picture and trying out new approaches to visualize the details, but to start let’s by identifying the high-level sections.

State money

In the centre of the structure, we have the central bank, which is the star of modern money systems (it exists in complex union with a state treasury, but I’ll fit that into the picture later). It issues state money in two forms. Firstly, it issues digital state money, which is what banks use between themselves. This digital money is called reserves, and you can see it glowing in orange in the centre of the picture. Secondly, the central bank (and treasury) issues physical state money - cash - which are those crackles of orange you see on the ground in the image. Think of cash as being like state money that has ‘leaked’ out of the enclosed system above (or, perhaps, parachuted out), and which now moves between us on the ground.

(Also, for those of you in the Eurozone, I’ll be sketching out the ECB system in due course, which is unique in issuing a kind of ‘meta-state’ money).

Bank money

The secondary ring around the central banks is made up of commercial banks. They hoover cash away from us, transform it into digital reserves at the central bank that they control, and in turn issue their own digital money to us, which they record in their datacentres. They also have the ability to massively expand the money supply through ‘credit creation of money’, during which they expand the units they issue. I’ll create images to show exactly how this works, but for an initial description, check out this video I made.

Third-tier ‘plug-in’ money

Institutions like Paypal, WeChat, M-Pesa and all sorts of ‘mobile money’ providers and platforms can ‘plug-in’ to banks, getting accounts with them and in turn issuing their own digital promises to us, which becomes like a third-tier form of digital money, tethered to the second tier form, which is anchored into the first tier form.

Money in orbit

In due course I can explain the interactions between the three tiers, and the actual process via which they issue and retract money, and the circuits that form. For now, though, conceive of the two outer parts as being in orbit around the central bank core, which anchors the banks, which in turn anchor the plug-in institutions. Here is a composite animation.

The payments system

In due course I’ll also go over the payments system, which is the system for reassigning the digital units in tier 2 and 3 between different accounts, which sometimes manifests as changes in tier 1. Every time you do a ‘contactless’ payment, for example, it looks a little bit like this:

The image above only shows the banks - who control the underlying digital money system - but to show the details I’ll have to add in intermediaries like Visa, Mastercard and others (such as those digital apps like Apple Pay), as well as sketching out the elaborate international payments system via which national systems are strung together.

Hot topics, and monetary rebellions

The reason for sketching this stuff out is not for mere intellectual interest. It’s so we can begin to feel more in touch with the world we live in every day, and also so we can get to grips with the deep politics of money, which have big consequences for almost every aspect of our lives. Once we can visualize the basic monetary picture, we can start to visualize…

1) The war on cash

The ‘war on cash’ is a concept I use a lot. It refers to the destruction of the ground level state money system (which you see in the state money image above as crackling trails of orange on the ground). Once cash goes, we have the dangerous situation in which our every economic interaction must go via the ‘hovering’ banking sector, which leads to all manner of issues, from surveillance to exclusion and resilience problems.

2) Big tech and payments geopolitics

Big Tech is trying to insert themselves into the payments picture by entering into deals with Big Finance, or by ‘plugging in’. Payments are increasingly a major zone for massive data grabs and geopolitical battles. They are becoming one front in the broader drive to build out massive systems of cybernetic surveillance capitalism, which in turn can be used by authoritarian regimes to discipline entire populations.

2) CBDC

There is a major debate emerging right now about ‘central bank digital currency’ (CBDC), which is the situation in which central banks open themselves up and start allowing ordinary people to access digital reserves (which currently are only available to banks). To some, this looks like another step in building out surveillance infrastructures, but to others, it looks like a welcome attempt to curtail the power of the private banks. Indeed, commercial banks are afraid of it, because it could severely disrupt their business, which is why they are lobbying the hell out of states to stop them doing this.

3) MMT

Many economists and commentators are very upset about a group of monetary rebels that operate under the banner of ‘modern monetary theory’. Actually MMT is pretty old and well established, but it has been villified in the press due to the fact that it humiliates a lot of established commentators who for years have beem complicit in misrepresenting the nature of state money. More on this debate to come!

4) Bank monetary reform

For a long time there have been campaigns against ‘fractional reserve banking’, which is the old-school way of describing the afore-mentioned ability for banks to issue their own money to expand the money supply. I look forward to sketching this one out.

5) Stablecoins

Cryptocurrencies have tried to attack the state-bank monetary system in various ways, but right now exist in symbiosis with it, with people buying and selling crypto-tokens for fiat currency. There is, however, one major development, which is the world of ‘stablecoins’. Think of them as being like a decentralised version of Paypal in tier 3. Facebook’s Libra was initially conceived of as a kind of stablecoin system - run by a corporate consortium - that would stretch out across numerous national monetary ecosystems by plugging into all of them in the background. I illustrated the concept in this video, but more imagery on this to come.

6) Alternative currencies

There is a hidden world of alternative currency experimentation that exists locally on the ground, under the shadows of the hovering bank system. Mutual credit systems are the ones I’m most interested in - and there is an exciting new wave of mutual credit experimentation going on - but alternative currencies come in many different forms. Some forms, such as voucher-based local currencies, are actually tethered into the hovering bank structure, and if you want a detailed account of one of those systems, check out my subscriber piece on the Tenino Wooden Dollar.

7) Everything in the shadows

The capitalist monetary system interlocks into huge transnational corporate entities, which I will visualize later, but pre-capitalist forms of economic life still exist on the far margins. For example, check out my piece on ‘shell money’ in Papua New Guinea, which is a limited-purpose ‘cere-money’ system that can yield a lot of insights into logics that existed prior to the rise of all-purpose commercial money.

Want to go deeper into the fascinating world of money? Become a paying subscriber!

The big prize. Visualizing global finance

Monetary systems form the foundation for a much larger system of global finance, which is at the core of global capitalism. I’ll be sketching that out too, with all the bonds, shares, derivatives and massive corporate subsidiary systems hosted in offshore juridictions.

For now, though, it is crucial to recognise that the digitization of money is part of a broader drive to automate that larger system, which is being spearheaded by the fintech industry. The decentralised version of fintech (which increasingly bases itself on the stablecoin systems mentioned above), goes by the name of ‘De-Fi’. All these topics await. Many of them are not politically pretty, and some are downright scary, but I’m going to do my best to at least make them visible.

I’m happy to report that my newsletter has grown a lot in the last few weeks, but I’d love to build it even further, so if you’ve got a friend, colleague or family member who you think would benefit, please do share it with them!

Hi Brett - love these articles. You mention Mutual credit systems a number of times and I know you are planning to do stuff on this. Do you have any links in the meantime?

F'n brilliant. Love it.

Going to apply this to the Space Economy. The flying saucer datacenters in Low Earth Orbit make so much sense.