The Art of Crypto Kayfabe

You know the cage-fight between Bitcoin and the Dollar was staged all along, right?

Paid Subscriber can access the Audio Edition here

A warm memory from my young childhood was watching World Wide Wrestling Federation battles with my grandmother on her TV in the dusty town of Masvingo in Zimbabwe. One of the stars of the Federation (which is now called WWE) was The Undertaker. He scared the crap out of me, but I was dazzled by him. He’d stare down his challenger with demonic eyes. He’d even be carried onto stage in a coffin, and by the end of the fight he’d try to lock his opponent into it.

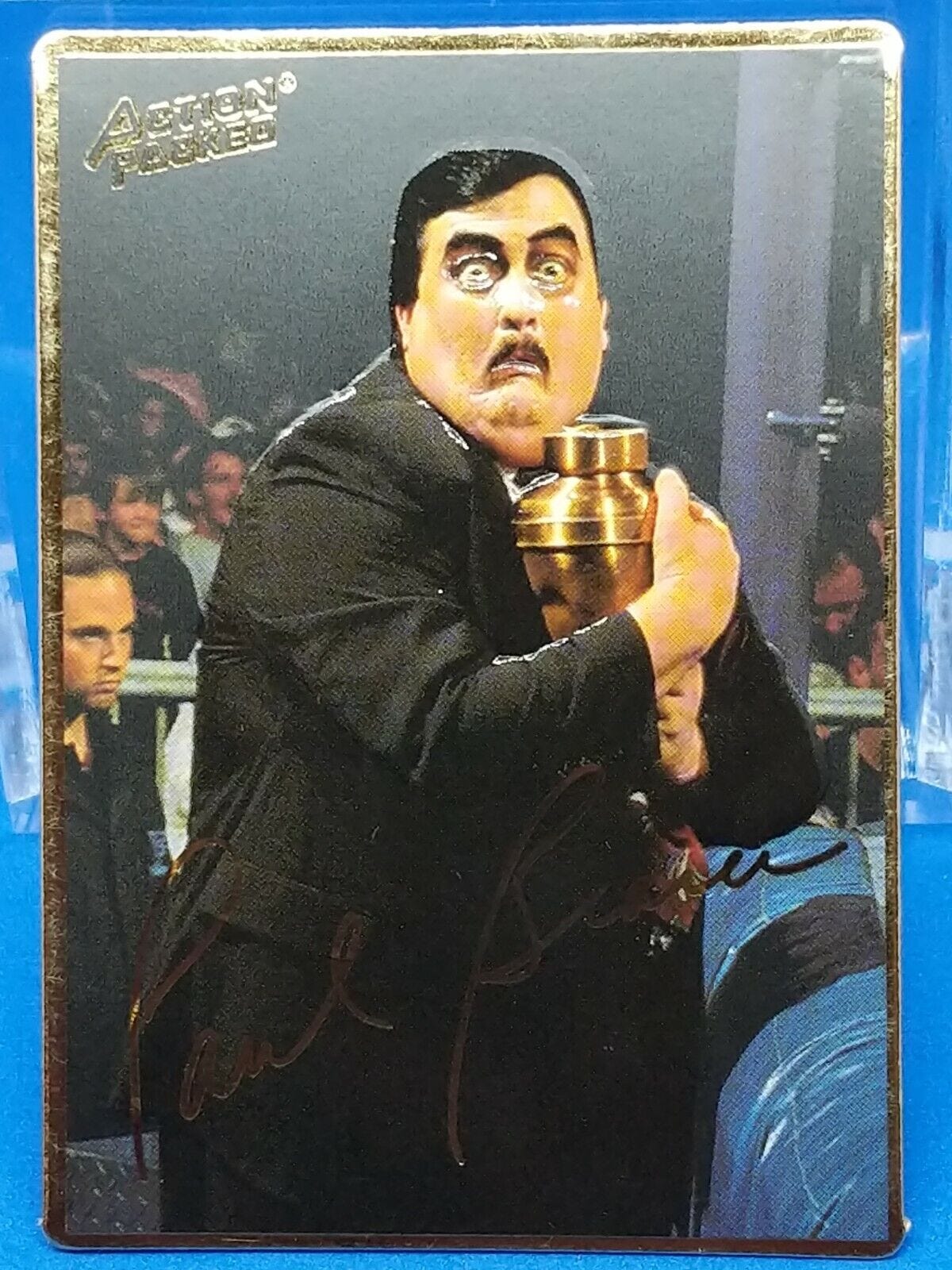

He also had this sidekick called Paul Bearer, who’d accompany him as a slithering hype man.

Paul’s job was to ‘summon’ The Undertaker and release him like a hell-hound against his opponents…

I was vaguely aware that this team was engaged in a gimmick of some sort, especially because all the other wrestlers also had their own hype-men, unique character and costume. They weren’t just fighters. They were stories.

In fact, ‘Gimmick’ is an official piece of wrestling jargon used to describe the creation of these unique personas.

As a kid, I was partially aware that the characters were acting a bit, but I did actually think the fights were real. In wrestling jargon, they’d call my young self a ‘mark’, someone who doesn’t see through the ‘Kayfabe’ - the fact that it’s all staged.

For a long time there was a big taboo in wrestling against breaking kayfabe. An old-school guy like The Undertaker would never break character, but last year I was delighted to see him finally do it. He removed his Gimmick, and appeared as his true self on the YouTube hit show Hot Ones. The terrifying Undertaker is actually a guy called Mark Calaway, and he seems very sweet and thoughtful.

In practice, kayfabe is hard to pull off, and it takes real skill to fake a fight without hurting yourself. If you’d like to get a sense for this, watch Calaway and Mankind - Mick Foley - do this fascinating and hilarious breakdown of their notorious 1998 Hell in a Cell Match, which went badly off-script: after being accidentally thrown through the roof of a cage, Foley’s tooth was stuck up his nose, and Calaway was whispering to him to call off the fight, while pretending to smash him with a set of metal stairs.

The instability of kayfabe, though, is also why it’s important for the industry to lean in on Gimmicks. If the crowd is vaguely aware that the fight isn’t entirely real, they at least need enough storyline to suspend disbelief, like they might while watching a film. The fact that we enjoy plays and novels shows that we don’t mind things being not entirely ‘true’, provided that they’re entertaining and tell us something about ourselves. In fact, as a wrestling spectator, you can experience yourself as part of the performance, getting caught up in mock horror and elation as part of a group.

So, that leads to another key piece of wrestling jargon - The Feud. This is a long-running staged battle between two fighters that intersects with other storylines, and creates dramatic tension for the fighting soap opera. A Feud might take place between a ‘face’ - a good guy - and a ‘heel’, a villain deliberately set up to be disliked by the fans. The organisers might have a ‘plant’ in the audience, a paid actor who taunts the heel and gets attacked, thereby attracting ‘heat’ - anger and disapproval from the audience, who might boo and hiss like rowdy theatre-goers in 16th century England yelling at a bad guy in one of Shakespeare’s plays.

The World Wide Wrestling Federation rebranded to World Wrestling Entertainment (WWE) following a legal dispute, and in doing so decided to tell people that it wasn’t an actual sports federation - it was entertainment. If you wanted to watch actual fighting, you could go to UFC - the Ultimate Fighting Championship - where people actually do beat the hell out of each other. WWE and UFC actually went through a merger in 2023, and are now owned by the same parent company.

The World Wide Investment Championship

I’m telling you about this, because in many ways the investment world is also like a fighting league, in which different investment assets battle it out. The assets range from the sober, dull, and solid - like bonds in a blue chip corporation - to the extreme and clownish, such as lottery tickets and roulette gambling, which nobody truly believes are serious contenders, but are fun nevertheless. It’s a bit like UFC and WWE merged into one, so let’s call it the WWIC - the World Wide Investment Championship.

In all cases, the ‘fighters’ in this championship want you to back them by putting money in. They parade around, showcasing their feud with some other asset - stocks vs. bonds, bonds vs. real estate, real estate vs. fine art, fine art vs. fine wine, fine wine vs. shares in a restaurants that sells fine wine, shares in restaurants vs. shares in games companies, shares in games companies and restaurants vs. emerging market bonds, emerging market bonds versus gold, and so on.

They’re all there for you to choose, like selecting a fighter in an arcade game…

Each fighter will attempt to attract you with their Gimmick, and each will have its own unique story and hype-men.

For example, financial assets like shares and bonds are united in being ‘productive’ - in the sense that you’re handing over money for a financial contract (see my Lego Model of Financial Capitalism), and that money will theoretically be used to build new productive enterprises in the world, which can give rise to new products that get sold, leading to interest and dividend streams coming back to you via the contract.

So, a hype-man for shares might go around telling you how ingenious a particular plan for extracting profit like this might be: Invest in Australian bauxite mining! Big global demand for aluminium but big shortage of bauxite to extract it = big sales! Major opportunity!

Something like gold, by contrast, is essentially ‘unproductive’. It’s just metal that was already mined. If you buy it, it does nothing. It just sits there, but you can try to resell it later for more. That’s the only way you’re going to extract profit out of it. Share hype-men would probably diss this as ‘unproductive speculation’ rather than ‘productive investment’, but gold’s hype-men will say hedge yourself against risk and inflation! When everything else goes to shit people want shiny yellowish metal! Buy gold!

These stories seem very diverse, but they’re united in one thing. The hype-men and fighters are all parading around in the same investment universe. Much like UFC and WWE host a stable of players who fight each other under that league’s banner in a shared fighting ring with shared referees, so all these investment assets turn up in ‘the markets’, competing for your money. You hand that money over for the asset, and then hope to extract money out later, either by reselling the asset (capital gains) or by receiving an income stream from it (dividends, interest, royalties etc).

Switching between WWIC sub-leagues

For the average person, ‘investment’ means letting go of money and hoping that it will come back later in a greater amount, but - with some contortions of language - some professional traders claim to ‘invest in currency’. This is a confusing concept, but it emerges due to a little glitch in reality: we live in a global economy with a global monetary system, but experience that within national borders. There are two things to understand about this:

The global economy is a meta-system made up of a whole series of subsystems called ‘national economies’

And, the global monetary system is a meta-system made up of a mesh of national currencies woven together through the US dollar (hence it being called the global ‘reserve currency’). Think of this mesh as a network-of-networks

So, if you’re one of the tiny percentage of people who is a professional currency trader - someone who professionally occupies the borderlands between each interconnected currency network - you can attempt to secure profit by switching between sub-system currencies (‘FX trading’).

In our metaphor, FX trading is not the process of ‘selecting a fighter’. Rather, it’s more like selecting a sub-league, like switching between Latin American UFC and Australasian UFC, all of which are part of Global UFC. So, in the image below, you’ll see that all the assets are fighting each other under the Dollar WWIC.

The WSMOSC

For the vast majority of people, money is not an optional ‘asset’ that you ‘invest’ in. Rather, it’s literally how you survive in a market economy where everything is priced in money. In this sense, investment assets - the fighters competing above - are actually also competing with everything else priced in money, like baked beans, smartphones, and packaged holidays to Greece.

In fact, when you zoom out, you’ll see that the WWIC is itself part of a much bigger league-of-leagues called the WSMOSC - the World Wide Spend Money On Stuff Championship. If you want to get a sense for the scope of that, see the image below. The WWIC is on the right, but one of its biggest competitor leagues is the WWCC - the World Wide Consumption Competition, where things like baked beans compete. If people are throwing money into that ring to buy groceries or cars, they’re not buying shares, or bonds.

In the end, all these leagues fold into each other, and the main slogan of the WSMOSC is Spend Money on Stuff Priced in Money. The easiest way to see this basic distinction is by walking into a supermarket. You see lots of diverse goods on the shelves, but they’re all priced in the same currency. When you zoom out, and abstract that to a global level, we have a giant ‘supermarket’ of Stuff, with millions of different things (‘fighters’) competing to get bought with the global monetary system, which is that network-of-networks dominated by the US dollar.

The dynamics of the ring

So let’s return to the WWIC. In our metaphor, the US dollar system is a core part of the main ‘ring’ where the investment assets get in and fight each other. The reason a particular share price on the New York Stock Exchange is going down is because more people are trying to sell it for dollars than are buying it, and the reason that another share is going up might be because those same people are redirecting their dollars to buy that instead.

In any case, the dollar remains unaffected, much like WWE or UFC remains intact after one fighter wins and another loses. It’s true that the dollar itself might be affected if everyone piles out of the NYSE and into the Tokyo Stock exchange - switching sub-leagues - but the overall monetary system, the network-of-networks, remains unaffected.

By contrast, something like inflation is a system-wide phenomenon that comes to affect everything that’s priced in a currency. It’s a bit like the UFC or WWE being unstable as a whole. It might have impacts on the individual fighters within those leagues, but it’s not necessarily the core part of their individual feuds. It’s more like they’re trying to fight each other in a shaky or shifting ring.

It’s true though that some of them are better than others at doing that, hence Gold’s hype-men will shout out ‘Gold excels when the ring is shaky!’ Share hype-men, Real Estate hype-men, and Fine Art hype-men all make the same claim though. In fact, when I worked in high finance, there were genetically-engineered fighters called Inflation-Linked Bonds designed specially for that.

The Contestant from Parts Unknown, and the Meta-Feud

Now here’s a little bit of wrestling lore. There’s an old practice of obscuring a fighter’s actual place of origin and labelling them as coming from ‘parts unknown’. This was done to increase the sense of mystery around who and what they were.

Perhaps the fighter also concealed their identity behind a mask, allowing for audience members to project their own hopes, dreams, and imaginations into the character. My favourite masked wrestler was Ray Mysterio. He was actually from California, but he appeared in wrestling culture as the mysterious guy from south of the border, taking on the all-American boys.

These ‘mystery man’ Gimmicks have always been popular, but another enticing storyline in wrestling culture is the ‘meta’ feud, battles that take place for management of the league. One variant is the ‘authority storyline’, in which big bosses struggle for control of the business. Here’s an iconic example: Ric Flair battling Vince McMahon, the long time boss of WWE, for 100% ownership of the company.

At other times, it might be a defiant fighter that has a beef with the league bosses. This can be staged as part of the other storylines: for example, maybe the management won’t let the fighter take on his rival, so he’s going to take down the system. Maybe the management does corrupt ‘hand of God’ interventions to favour one player over the other, leading the player to seek vengeance and bring justice. Maybe he smacks the referee with a chair, because the latter is biased. Imagine The Undertaker walking into the ring, challenging the big bosses to a duel and shouting “I’m going to bury you WWE!”

So, what do we get when we combine these two storylines - the Contestant From Parts Unknown, and The Meta-Feud - and place them into the WWIC?

That’s right. Bitcoin.

Picture this scene. A procession of hype-men leads a mysterious robed figure towards the ring. They shout slogans, like: Hailing from parts unknown! Scarce! Limited Edition! Unstopppppabbllle! Censorship resistant! Destroyer of corruption. Breaker of empires. Bringer of order. Maker of fortunes! Introduuuuuuuuuucinggggg, the Greeeeeaaaaaaat DOLLAR-KILLAH!

The figure gets into the ring, and tears off their robes. The first thing you notice is that they’re dressed like a referee.

The dual storyline

Bitcoin probably has the loudest hype-men in the history of the WWIC. I’ve even been among them. In the very first article I wrote about Bitcoin in June 2012, I said this:

More than anything, I have the sense that Bitcoin is a cult. A cybernetic cult. An anarchic techno-pirate, quasi-mystical collective on a mission to subvert the global monetary system. I guess that’s why it attracts me.

That’s the original storyline. Bitcoin’s entire reason-for-being, apparently, is to tear down the current establishment, and in particular to tear down the biggest management faction in The League, the US dollar system. In this story, Bitcoin is uninterested in the other fighters. Rather, it wants to be the currency for all the others. In other words, it wants to put the WWIC, and the WSMOSC for that matter, under new management.

In this storyline, the hype-men talk about the corruption, coercion, debasement and generalised hedonism of the world’s central banking establishment. In this story Bitcoin appears as a pure-hearted seeker of justice, like Galahad in King Arthur’s legends.

But wait, it gets more complex. Such a Galahad risks being seen as a naive romantic, so Bitcoin’s hype-men actually have a second storyline too. In this one, Bitcoin is a dickish brat that wants to destroy the other fighters while staying in the Dollar WWIC. The hype-men swagger about bragging about how it’s ‘going to the moon’, doing much better than all the other assets, as measured by dollar returns.

The Tag-Team

These two storylines are in fact incompatible, but the Bitcoin hype-men are very skilled at mix-and-matching them. In fact, they get them to operate as a tag-team.

You probably know the term ‘tag-team’ because it’s one of wrestling’s most famous buzzwords. You have a team of two people, but only one is able to fight at any particular point. The other has to stay outside the ring until the other ‘tags’ them by slapping their hand and allowing them to jump into the action. So, Bitcoin’s great power is it’s ability to tag between it’s two separate characters:

The first is The Great Dollar-Killah, which is that character with the meta-feud storyline in which they want to replace the management

The second is The Mighty Hodlr, the cocky fighter that disses all the other fighters, and brags about how high its dollar-returns are

Tagging between these characters shifts the interpretation of any particular sequence of action. For example, when Bitcoin is in Hodlr mode, a rise in its price is called asset-price appreciation. It’s beating the crap out of the other dollar-denominated fighters. The same thing in Dollar-Killah mode, though, is - apparently - ‘deflation’: it runs a more stable ring, or something like that.

If the price is going down, though, the hype-men very quickly tag the storyline out to Hodlr mode. That’s because they don’t want to say that a 30% drop in the price is 30% ‘inflation’. Rather, they turn it into a defeat-and-comeback storyline, in which the Mighty Hodlr is down but not out, and will return in greater force in the future.

More generally, this switchability is important ideologically, because it enables the hype-men to confuse the crowd with all sorts of mind-bending gaslighting. They keep fluctuating between characterising their champion as sometimes a fighter, sometimes a referee, or sometimes simultaneously both.

The Signature Move: Countertrade

This tag-team action comes together in Bitcoin’s signature move. Here’s the sequence:

It arrives in the ring as The Great Dollar Killah. It comes branded with all sorts of ‘money’ bling, garb that makes it look like a referee. The hype men build the Meta-Feud storyline to get the interest of the crowd, but then encourage the crowd to throw their dollars at it (rather than throwing their dollars at - for example - shares in the stock market)

In doing this, Bitcoin transforms into The Mighty Hodlr, an asset with a dollar price, fighting other assets while the true referee - the US dollar - looks on

Then, in the final twist, it uses the dollar price to reappear as The Great Dollar Killah. But how?

The key to understanding this transformation act is to understand the subtle concept of countertrade: if an object has a price, it also has a resale price, and a resale price can be used as payment to buy something. You can do this with anything priced in money, like baked beans, vintage wines, gold bars, real estate or anything that’s sitting on your desk right now. Let me give you some examples of countertrade:

You have a vintage vase on your desk that costs $100. You owe your boiler-repair guy $100, but don’t have cash on you, so you say, “hey, do you want to take this vase in payment. You’ll be able to resell for $100”

You buy a jacket for $100, but decide to return it. The shop-keeper says “if you’d like, you can swap it for something else of equivalent price”. So, you swap the jacket for a $100 handbag

You’re on holiday with your friend and you spend $100 on accommodation. They’re about to pay you half of that, but you say, “don’t worry, just get us $100 of fuel for the car and we’ll call it quits”

You’re an international mining company and you receive $50,000 worth of fuel from a petroleum company. You’re going to pay, but they say “we actually owe our cement manufacturer $50,000, so can you just give them $50,000 worth of crushed stone for their cement?”

In all these examples, you have different goods and services - all priced in dollars - that are being swapped with each other via their dollar resale price. In all these cases, the dollar could be used instead. For example:

You could sell the vase for $100 and then give it to your boiler-repair guy (or, they take the vase and resell for $100)

You could get a refund of $100 for your jacket, and then hand it back to buy the bag

Your friend could pay you $50 for their half of the accommodation and then you pay it back to them to cover your half of the fuel

You could pay $50,000 to the petroleum company, who then pays it to the cement company (who may then pay it to you for crushed stone)

So, what was actually happening in all the original scenarios were disguised dollar transactions that took the form of objects moving around without dollars. This is countertrading.

In typical cases of countertrade, we can see that it’s happening. Nobody thinks that you used a jacket as ‘money’ to buy that bag, or that you’re ‘paying’ for accommodation with fuel, or that crushed stone is a ‘currency’ on the FX market that can be used to get fuel. You’re just doing clearing, cancelling out dollar-denominated debts by moving dollar-priced goods around.

Bitcoin, though, has a surprisingly basic tactic that confuses everyone. It dresses up as money, thereby making countertrade look like monetary exchange. It’s really that simple.

Most people experience money as ‘numbered object that moves and then goods come’. On the surface, Bitcoin looks and feels like that. It appears to you as numbers that have a little symbol next to them. In fact, if you strip away all the branding, and zoom into what Bitcoin is at a deep level, you’ll see that it’s a protocol in which numbers get written out after energy is expended. That’s what Bitcoin ‘mining’ and ‘minting’ is.

These numbers get called ‘tokens’, but it’s a bit like etching the number ‘50’ into a rock after struggling to the top of Mount Everest, and hoping that somehow the arduous journey to get the top imbues some ‘thingness’ into those numbers. In reality, in the early days of Bitcoin, there was no thingness. I know, because I was there. Nobody had any idea as to what they were, other than tokens - numbered digital objects that could be moved around.

In subsequent years, as the hype-man army was built, this fundamentally simple reality got disguised by a whole marketing apparatus. In essence, the numbers became gilded, plated in ‘metallic’ imagery and surrounded by monetary language like ‘deflationary digital currency’. The acronym BTC was put after them, so you could say ‘who wants to buy 50 BTC’. They started getting a price, and if you can get a price for them, you can get a resale price, and a resale price can be used for countertrade. I know this, because I used to ‘sell’ things for Bitcoin, and ‘buy’ things with it, and in all cases it was actually countertrade.

Countertrading Medallions

To get a sense for this, picture yourself walking into an antique shop, and seeing all sorts of old goods with prices on them. In one corner, though, there’s a gilded medallion, engraved with attractive symbols. On the surface, a medallion sort of looks like money, but - like all the other goods - it has a price tag, in this case $100.

Next to the medallion is a lovely vintage hip flask that also costs $100, so you decide to buy them both. Now let’s imagine a weird twist. The shopkeeper tells you that the price of the flask is $100, but in the case of the medallion he calls its price an ‘exchange rate’, and - as you buy it - he says it’s an ‘FX transaction’.

But it’s not an FX transaction. You’re not a currency trader occupying the membrane between two currency networks. You’re a person buying a hip flask and a medallion with dollars. It appears that the antique dealer has been confused and taken in by the surface appeance of the medallion looking like ‘money’, and so has characterised it as an ‘FX transaction’.

Now imagine you place these two objects on your desk at home, as your boiler-repair guy fixes your heating. You realise that you don’t have cash on you, so you tell your boiler repair-guy, “hey, I just got this engraved hip flask for $100. Do you want to take it and call it quits?” He eyes it out, and says ‘nah, it will be a hassle to resell that’. You hesitate a moment, before reaching for the gilded medallion. You say “ok, how about I pay you with this… coin?”

The Trembling Dollar-Killah

Bitcoin happens to be highly counter-tradable, because it’s digital and easy to move around. To the untrained eye, that gives it the superficial appearance of the Great Dollar-Killah - you can use it in place of dollars. In reality, though, The Mighty Hodlr is in a constant speculative battle in the US dollar ring with other goods, which means its dollar price is constantly rising and falling, which causes problems for it’s alter-ego’s attempt to maintain the appearance of being money.

The easiest way to see this is to go to El Salvador, and turn up to a restaurant in Bitcoin Beach. You enter at 7pm, and look at the menu. The first thing that you’ll notice is that - actually - the menu is in US dollars, but the management is happy to accept Bitcoin. Three things then happen:

You order a group meal that costs $100. As you order, the Mighty Hodlr has reached a career high of $100,000, so - in its Great Dollar Killah form - Bitcoin appears as a ‘price’ for the meal of ‘0.001 BTC’. In other words, if you gave the restaurant owner 0.001 BTC, they’d be able to resell it for $100

Of course, in a restaurant you don’t normally pay up front. You pay at the end. You begin eating, but by 8pm the Mighty Hodlr has had a set-back in the US dollar ring. People are selling it, and buying GameStop shares instead, so it’s knocked to $90,000. This means, The Great Dollar Killah must reset to ‘0.001111 BTC’ to maintain the resale price of $100 for the restaurant

By the end of the meal at 9pm, you call for the bill. By this time, Hodlr has recovered to $95,000, meaning that the restaurant owner presents you with a bill for 0.0010526 BTC. Great Dollar Killah was trembling the entire meal, while Dollar - the actual price of $100 - stayed constant.

The Split Personality: The True Story of Parts Unknown

In the WWIC ring, what was actually happening above is that the true referee - the US Dollar - was standing still on the sidelines, watching a fight between, for example, Gamestop shares and the Mighty Hodlr. But here’s the big reveal. In reality, this fighter isn’t actually part of a real tag team. Rather, they fantasise this.

In fact, the true dark storyline is one of a tortured but lovable character - like Don Quixote - who has a split personality and who talks to an imaginary alter-ego that they tag in and out of the ring. As they grapple with various fighters - such as gold, bonds, rare artwork, or baked beans - they image these fights as battles against the big bosses, but there’s no meta-feud going on. Bitcoin’s price isn’t due to action on the FX markets. It’s due to people deciding that they’d rather spend their spare $1000 on a holiday to Greece, or to not spend it on a mountain bike and get crypto instead.

What’s crazy - and intriguing - about this character, is that it always arrives in the ring calling itself the Great Dollar-Killah, with hype men that use that to pump the price, relying on the crowd’s inability - or perhaps unwillingness - to tell the difference between a true referee and a false one. The battle then ensues, with the US dollar referee watching from the sidelines while Hodlr beats up other fighters, and then tags in its imaginary alter-ego via that mechanism of counter-trade that’s hard to distinguish from actual monetary exchange, because - well - the player is dressed up as money, wearing that referee bling.

But this split personality act is vulnerable, because it’s circular: to appear as the Great Dollar-Killah it must succeed as Hodlr, but to succeed as Hodlr it needs to appear at the Great Dollar-Killah. After all, Bitcoin has no other option. It’s not real estate, or fine wine, or an Australian bauxite mine. It’s literally limited edition numbers written out, and then fragmented into pieces.

But wait, isn’t all money ‘just numbers’?

This is the point where the Bitcoin hype-men will almost certainly counter-attack by shouting: all money is just numbers!

That’s where I call hard bullshit on them. The actual monetary system is a coercive and extractive credit vortex underpinned by powerful legal structures, military and the commercial banking sector around the world. That’s why it works, and that’s how the entire WSMOSC League functions. Capitalism isn’t some merry ye olde market. It’s a gigantic global organism built upon state foundations that uphold private property laws, allows corporations to exist, and hold the reins of a transnational money system that both expands and contracts.

Money isn’t ‘just numbers’, even if it appears with numbers, and the mere fact that Bitcoin is a movable numbered digital object means nothing. A flattened bottle cap found on the road, or a highly rare ornate amulet, or a piece of round plastic, could also have numbers etched into them. They could also be moved. They could also be countertraded. That doesn’t make them anything like the dollar.

Hodlr’s Achilles Heel

The real problem faced by The Mighty Hodlr is the circularity of its story. Counter-tradability is an emergent property of something that gets a price through some other rationale, but when you pierce through - and translate - the surface story of Bitcoin, you’ll see that the rationale offered is: you can countertrade this.

This circularity of course cannot be admitted, because then the story collapses. So, no wonder Bitcoin needs so many hype-men. No wonder it needs an entire industry of theologians who spin mystery around it and warp its story in all directions. I’ve seen so many of the stories over time. Some of the promoters are out there claiming it will solve climate change and poverty. Apparently it’s going to regulate the power grid. Some present it as a symbol of defiance to wokeism. Others hold onto the classic story of it being a deflationary currency to save you from the US dollar by making you rich in US dollars.

There’s something in that last argument. Something dark. Perhaps the darkest of all the secret storylines.

Here it is. The primary management faction in WSMOSC is actually called AmericaFirst Denominator Dominator. They are an old, violent and coercive faction who supports the US dollar as the dominant global currency in that big network-of-networks.

To these people, Bitcoin is a useful clown-fighter to have in their league. They like the fact that Bitcoin dresses up as a rebellious rogue referee, which the crowd love, while promising the crowd dollar returns. They know full well that this fighter doesn’t have the power to overthrow The League with its army of bouncers, enforcers and lawyers.

They also love the fact that Bitcoin promoters will do anything to avoid admitting this. The latter even have special arguments to defend against this line of attack. They say: Maybe it’s true right now that Bitcoin is just the Mighty Hodlr, but if its price increases enough, it means that it’s getting closer to being the Dollar-Killah. Somehow, provided that Bitcoin gets ever higher, it will become the management. Really? That’s like saying if fine wine gets more expensive its getting closer to being the US dollar.

No, the most it can actually hope for is to become a culturally entrenched fighter like gold. Note that gold isn’t a currency. It’s one of the contestants. Unlike gold though, which has thousands of years of cultural history behind it, Bitcoin is a shaky star fighter, because when you take the mask off, the fighter looks a helluva lot like someone being propped up by US dollar counter-trade, and a lot of people look a helluva lot like marks, taken in by the kayfabe of the Feud.

The Final Gimmick

Ah. But that’s where I’m probably the mark. After all, the WWE isn’t supposed to be real. At some deep recess in even the most hardcore Bitcoiner’s mind, there’s some awareness that they’re taking part in a performance, and it’s a fun and exciting one, in which you get to be an audience member who is in on the Gimmick, part of the grand story, part of the action.

In that meta-meta storyline, someone like me, who is pointing out the contradictions, appears as the one who is taking it too seriously. We all know it’s a joke Brett. It’s just that we suspend disbelief and enjoy the ride.

There’s a reason why Trump and Musk have partnered with the crypto industry. All three specialise in selling dreams, and many people enjoy buying those.

But, in a special cage fight edition of the WSMOSC, the very same administration that trumpets the The Great Dollar-Killah also reveals that they’re fighting for the AmericaFirst Denominator Dominator faction.

So, that leads us to our last piece of wrestling jargon. The Double Team is where two imagined enemies join forces and reveal themselves to be on the same side. It's the ultimate Gimmick, and the crowd goes wild.

Brett, this is the best debunking of Bitcoin and similar artificial digital commodities I've ever seen.

Bravo!

The real Dollar-Killah requires reclaiming the "credit commons," i.e. community control of credit that producers and sellers of real value allocate to one another, along with denomination of that credit in units based on a real commodity or group of commodities. My recent presentation at the RAMICS Conference in Rome described how that can be done. I'll be posting it soon on my website beyondmoney.net and on my Substack channel.

Thanks, I wasn't quite sure where it was going - got a bit lost in the abbreviations maybe, but then it became very clear. And what a great analogy, something in the tone of the whole crypto business is really well represented by the atmosphere of wrestling (if you ever go to Mexico City I highly recommend the wrestling there, it felt like a much purer, more essential, and somehow more honest expression of the same kind of show.) A couple of thoughts arising:

1. Maybe better to call them pseudocurrencies?

2. Is there not also an inkling, somewhere in the background of our relationships with the standard monetary system monster, of a similar sense of 'taking part in a performance?' Even if we know that the value of the money we use comes into being through a vastly complex multilayered web of influences, there is also a sense that some of the influences behind that value are also somewhat arbitrary - and some people and groups of people have far more power in determining it than we as ordinary users do. The extent of that power is I'm sure debatable, and certainly one I have very little knowledge about.

So even if it's just a story, that a few people have the power to change it, whereas we are chained to the heavy immobility of its complexity, then perhaps what crypto is selling, with the story of 'money being just numbers', is that you too can see the truth behind the creation of value... and that will liberate you.

Though whether buying into crypto could ever give you any similar power - to also make up those numbers without any influence from people of undesirable motive or association - is also highly questionable.