The War for our Wallets: Field notes from Oman

10 things I learned from central bankers in the heat of the Middle East

Paying subscribers can access a 50 minute audio briefing below

I’ve been on the road for the last week. Specifically, desert roads in Oman, in 41°C heat, in a small Toyota Corolla with a broken air-con. Soon after taking the photo above I got lost in a landscape that looked like it came out of Dune, with children in remote villages laughing at me as I tried to manoeuvre the rental car through sand drifts.

As an English-speaker, I often find myself publishing my work into the bubble of US-European thought, but it’s always a blessing to escape that comfort zone and to be confronted with something wildly different, and the Sultanate of Oman is certainly that.

I have written about how the world economy is interconnected, like a superorganism tied together by the global monetary system, but that doesn’t mean the interconnected parts don’t have their own logics. At a global scale, Oman is part of the energy complex we all rely upon - it sells oil to accumulate dollars - but at a local scale it’s a parallel world, tinted by parallel cultural filters and a parallel media landscape. While every Western news station rolls out its lopsided coverage of the tragic calamity unfolding in the region, every Arabic TV channel I saw while there was rolling out a parallel commentary, one in which Arabic people take centre stage, and are normal, rather than being strange others far away.

Just north of Oman, across the gulf, is Iran, while Yemen is on its southern border. Right now the Sultanate is an oasis of comparative calm amidst the conflict, but the region as a whole - and its oil - is of acute interest to every major power in the world, and has been for a long time. Oman was in fact a regional imperial power in the 17th and 18th centuries, with a great seafaring trade empire. I stayed for a couple nights in Sur, which was a launching point for Omani dhows to head down to Zanzibar, from where they were major players in the East African slave trade.

In the 19th century Oman fell into infighting, and British colonialists took the opportunity to extend their influence, signing treaties with local elites, granting them protection in exchange for securing their own imperial ambitions. Fast forward to 1970, and Sultan Qaboos took over as a modernizer, finally banning slavery and using the country’s growing oil revenues to undertake massive infrastructure projects.

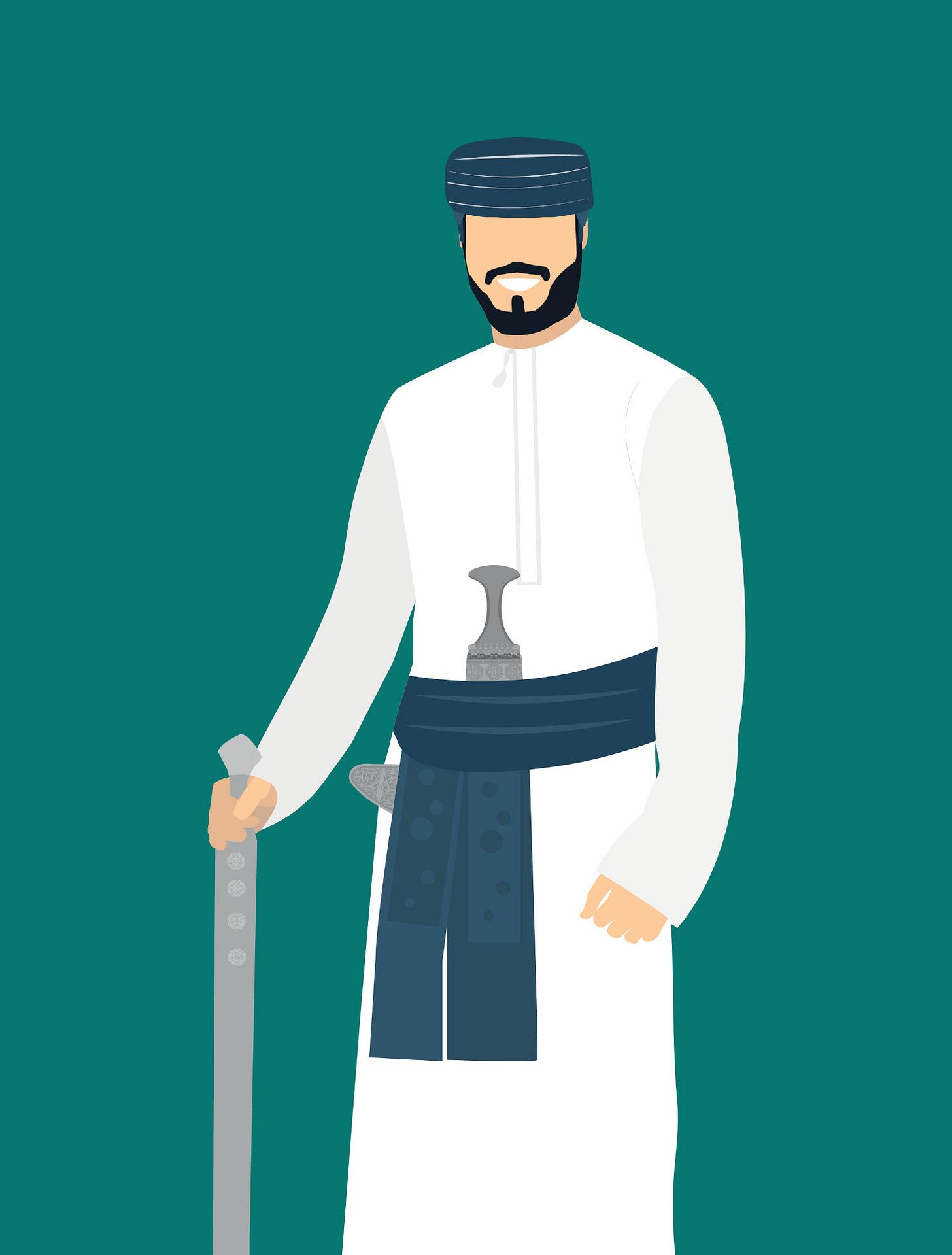

The sultan also used some of that money to hire some of my dad’s friends from Zimbabwe to train and serve in his elite armed forces. My dad is a former special forces soldier, and, yes, many of his friends are former mercenaries. In my childhood I’d hear stories about the Sultanate when they arrived back after lucrative soldier-of-fortune gigs. Oman certainly has a brutal past, and it most definitely is an authoritarian country, but nowadays it’s also very rich, which means it has that well-functioning autocracy vibe, like Singapore. In fact, some people call it the ‘Switzerland of the Middle East’, because the country tries to stay out of regional conflicts and hedge its geopolitical bets, but the historic violence of imperial trading life still turns up in symbolic form in the ceremonial Khanjar dagger that Omani businessmen wear as part of their formal attire.

As business attire goes, I must admit that the Omani style is way more bad-ass than dull European suits (side note: I wonder what ceremonial weapons an English banker might wear in a parallel reality?), but for a couple days in Oman I was surrounded by different forms of formal attire because I started my trip at the Global Currency Forum, a get-together for central bankers and currency industry folks, set within the tinkling piano music of a five-star hotel resort on the coast below the capital city Muscat.

Because I’m a defender of physical cash, I sometimes get invited to these shindigs and get to meet a fair number of central bankers. The great thing about hosting these forums in tourist complexes is that, eventually, the central bankers get drunk, shed the suits and start wearing tiki shirts, and that’s when you can start to tap into what they really think about things (Oman is Islamic, but they do allow alcohol to flow within the hotels that Western investors and dealmakers inhabit, knowing how it loosens things up).

My primary mission while there was to do pro-cash work among central bankers, and to suss out the vibe in the global monetary system from the executives present, but I’m also an anthropologist, and I couldn’t help but notice that the majority of people doing the non-elite menial work - serving, cleaning, construction etc - were from India, Bangladesh and Pakistan. This sent me on a side-quest, in which I discovered that about 30% of Oman’s population is made up of these migrant workers (in the nearby UAE, the percentage is much higher, at 85%). After chatting to some Indian hotel workers, I discovered it’s seen as a good temporary place to build up some savings before returning home, because wages are good while the oil revenues roll in.

Still, like all Middle Eastern oil states, Oman is very aware of how precarious it is to rely on a single commodities like this - half their GDP is accounted for by oil and gas - so they take their oil money and funnel it through their sovereign wealth fund to buy up non-oil assets - like shares in US tech companies - to diversify.

That takes us back to that strange meeting between the local culture - formed in the scorching desert winds - and the global system, with its interconnected stockmarkets and interconnected currency ecosystems. So, what did I learn about the latter at the Global Currency Forum 2024? Below you’ll find an audio and text briefing of 10 big themes, in particular in relation to the battle between digital payments and good old hard cash in an age of AI.