Banks create money, but how do you explain this to the public?

Busting the biggest myth of banking is no easy matter

I was recently watching a great video from the iconoclastic ‘heterodox’ economist Steve Keen, in which he attacks some mainstream views on banking. Steve, like myself, is deeply frustrated by the way that orthodox economists - such as Ben Bernanke - continue to use the completely bogus idea that banks lend out the funds given to them by savers.

This ‘loanable funds’ model is both very old-school and very common, and it remains the mainstream view. It’s used on the popular finance education site Investopedia, and in a bunch of orthodox economics textbooks I have on my shelf. It’s totally wrong, but it nevertheless has reached the status of being ‘common sense’ to most people.

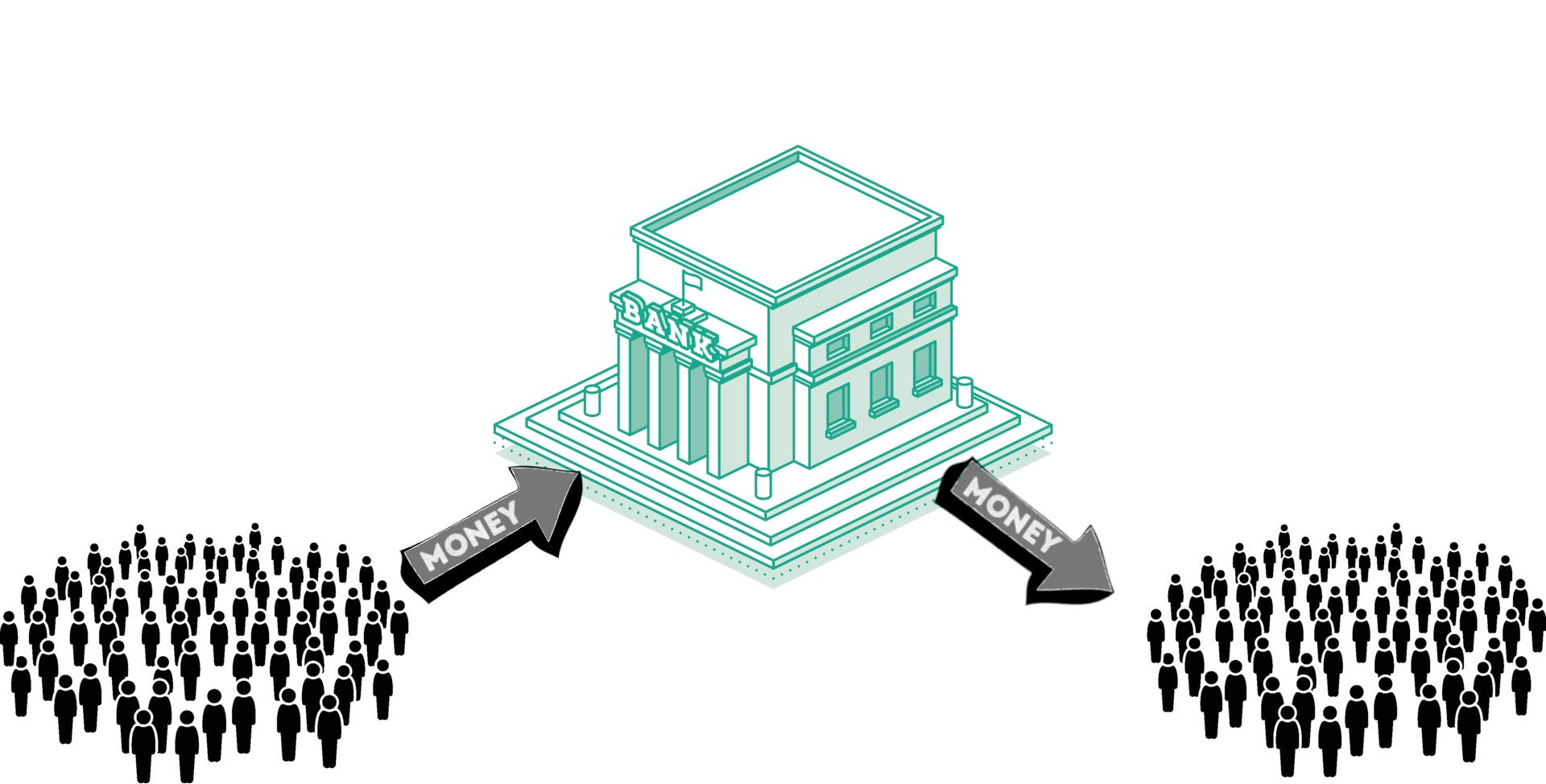

In this model, the true lenders in society are ordinary savers, people in the public who ‘fill up’ the banking sector with their money, and who then leave the banks to re-lend that out. Here’s how it would look in visual form, with money going from savers to borrowers via the banking sector.

Through this lens, there’s only one form of money in society - state-issued money - and the banking sector simply moves it around. Banks are not seen as changing the money supply, because they’re simply taking purchasing power from one part of society (savers) and giving it to another (borrowers). Banking is seen as a ‘neutral’ system of intermediation, creating a little boost to economic activity by transferring money from parties who don’t want to spend it to those who do.

For many years, critical thinkers on banking and money have tried to dislodge this model. Unfortunately, much like the Barter Myth, it’s one of those foundational ideas in modern economics that’s very hard to kill because it’s part of a paradigm, a network of ideas that require and respawn each other (so even when one of the ideas gets overturned it soon gets revived like a zombie by the others). If you’d like to explore some components of that paradigm, see this footnote1.

Because the mainstream model is ‘common sense’ to most people, and because words like ‘money’, ‘credit’, and ‘banking’ are loaded with preconceptions, it’s actually very hard to describe to a non-expert why the model is bullshit. I’m going to start by showing how I do it, and then conclude by comparing that to some approaches used by Steve, the Bank of England and Ray Dalio, the billionaire hedge fund manager.

Dismantling the intermediation myth in 6 steps

When I’m facing someone who believes that banks lend out money given to them by savers, I’m not only facing someone who is using a flawed model, but also someone who may very well have a flawed understanding of common terms like ‘money’. What’s more, they also might have their own critiques of this system, but built upon an incorrect understanding of it.

For example, there are many people who attack the banking sector for doing ‘fractional reserve banking’, but when describing this they use the mainstream economics model of the thing they’re attacking, which actually means they’re quixotically attacking a false image (for the record, it’s worth being critical about ‘fractional reserve banking’, but you need to actually understand the thing you’re critiquing).

So, to avoid triggering landmines in people’s minds, I have to carefully pick a path when laying out the alternative way of seeing things. Here are the six basic steps I use.

Are you a student? You can request a 50% student discount to get full access to all ASOMOCO posts. Message me here to request one: